Day 11: Plain

Plain brick can be just lovely when pieced together in this way.

Day 11: Plain

Plain brick can be just lovely when pieced together in this way.

Well, this is intriguing. Nikola is planning in releasing an electric and hydrogen-powered truck called the Badger. No price or production date yet tho.

Day 10: Sign

A sign of the times.

Trying to get myself back into writing actual stories. I’m always searching for tools & techniques that could make me a better writer while avoiding the one thing that will make me a better writer: writing.

That said, here’s an outline tool I think can definitely help anyone write more solid stories.

Day 9: Lull

I am lulled to sleep and floating on dreams of Disney as these boats float gently.

Day 8: Contrast

This high contrast photo of this puppy actually looks like a pencil drawing too lol

Day 7: Above

He tossed the ball high above his head.

Day 6: Plant

Plant a few trees and watch the beauty unfold.

I love this ship.

Day 5: Hide

Hiding from the light.

In this article, while referring to single sign-on services, we get:

“When you use Single-Sign-On (SSO) options like Google, Facebook, Apple, or Twitter, they even follow you across devices.”

Including Sign In with Apple in this demonstrates a solid misunderstanding of the feature.

Day 4: Spot

There’s a spot from which you can see everything!

Day 3: Reflect

Day 2: Sight

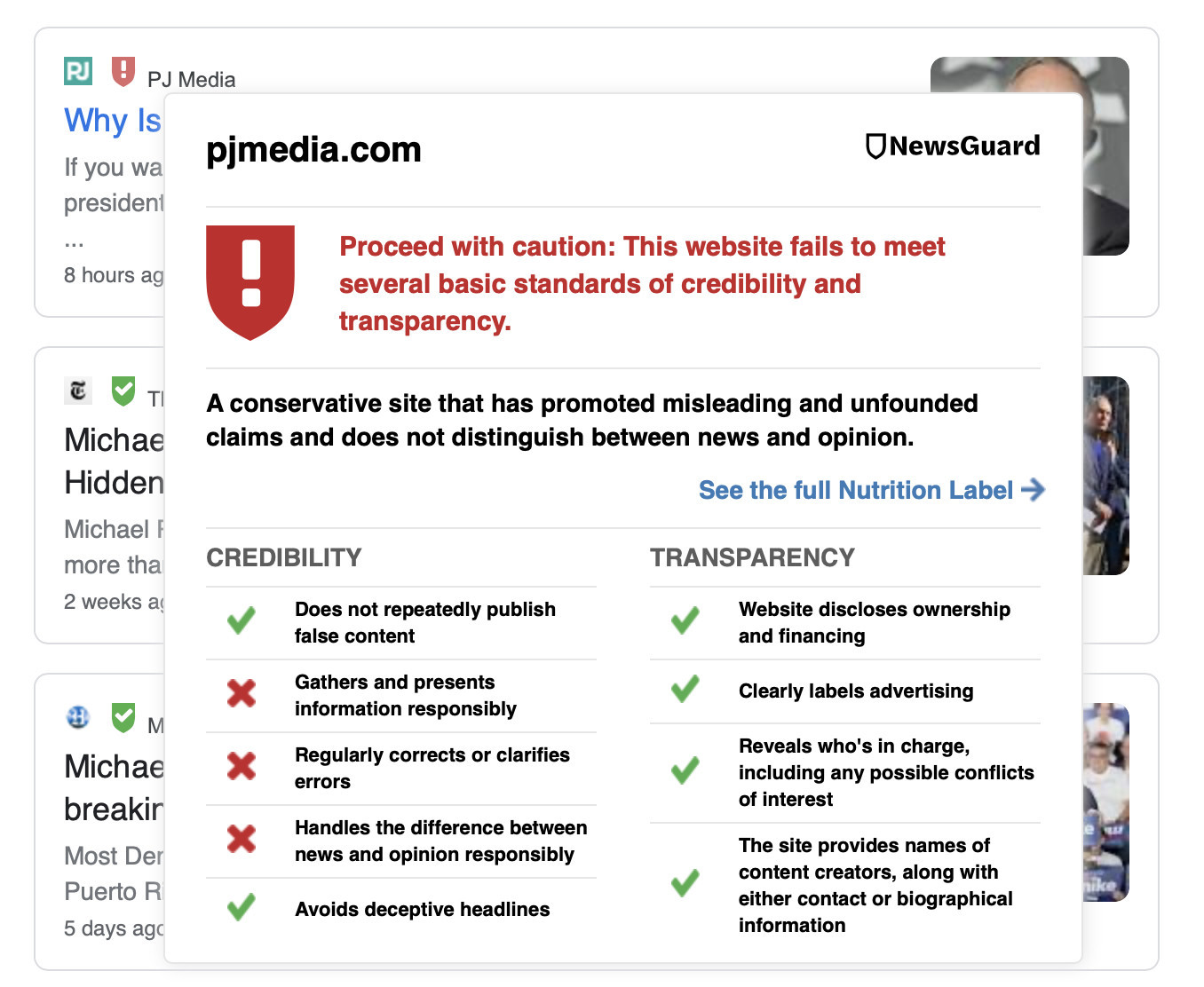

This little web extension called News Guard can be super useful at helping determine trustworthy news sources.

It marks a news search result with a little shield that’s either a green check mark or a red exclamation point that indicates the site is trustworthy for news and information or it is not.

Day 1: Open Open sky! And open your imagination!

Let’s make it an amazing day! 💪

From Daringfireball (@gruber):

This commentary referring to an article on Sign In with Apple’s popularity

I LOVE Sign In with Apple. I find myself disappointed when an app doesn’t offer it.

I don’t know why it bothers me that elected officials use their social media for official business. Also it apparently depends on whom it is. So maybe it’s less about the social media and more about the individual.

Facebook finally launches its Off-Facebook Activity tool.

I’m excited for our upcoming cruise. One week from tomorrow and we are off to Coco Cay, Cozumel, Costa Maya, and Roatán! Need some serious R&R!

Who has used or wants to use the Tiny Habits system? I’m just getting started but thus far, it’s really great!

Change of plans…

ORD🛫☁️🛬TPA

I love those moments when I urgently reach for my phone determined to do…something. Then I forget exactly what the hell I picked up my phone for.

ORD🛫☁️🛬CLT (at some point…damn delays)